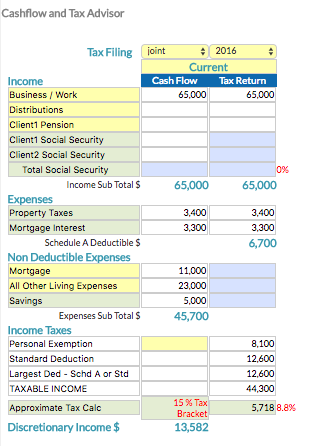

- Map client’s current cash flow, expenses and taxation position.

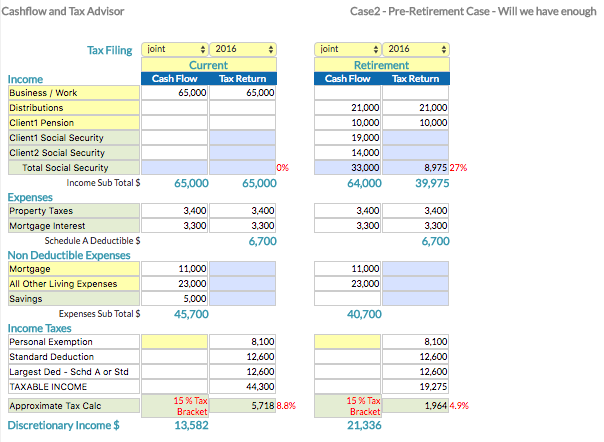

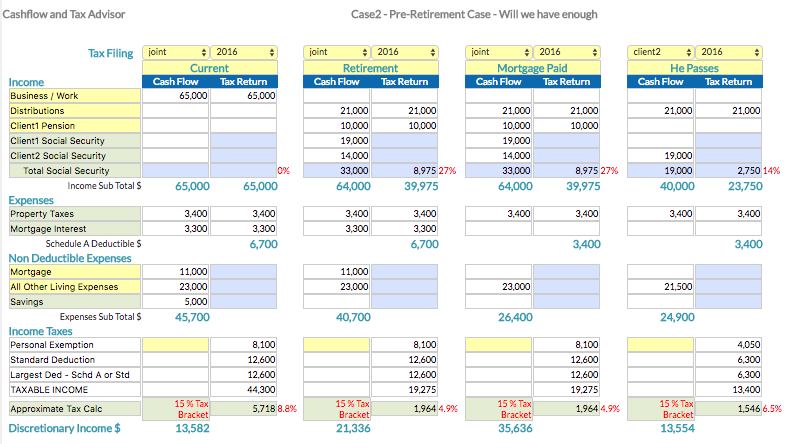

- Demonstrate multiple scenarios with different financial options along with taxation implications.

- Show possible future changes in their reality and their implications.

- Tax Module immediately calculates approx. tax liability including the impact of a financial strategy on taxes on Social Security income.

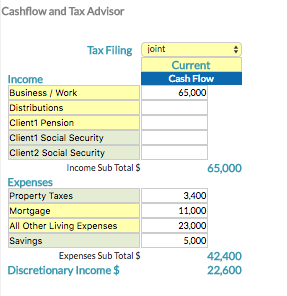

The SIPS Cash Flow and Tax Module allows for concise presentation of information uncovered in the discovery process with client. You will itemize all sources of income, categorized by type, as well as documenting outflows for all expenses. This makes for a clear snapshot of surplus income or indeed shortfalls necessary to maintain ones lifestyle.

The SIPS Cash Flow and Tax Module allows for concise presentation of information uncovered in the discovery process with client. You will itemize all sources of income, categorized by type, as well as documenting outflows for all expenses. This makes for a clear snapshot of surplus income or indeed shortfalls necessary to maintain ones lifestyle.